5 Reasons Why Life Insurance Is Important

If you are looking for exact reasons for “Why life insurance is important” or “Importance of Life Insurance” the simple answer is that life is uncertain; you never know what will happen the next moment! Therefore, it is necessary to prepare for the uncertainties of the future. Life insurance is one such medium that protects your loved ones during an untimely death.

Did you know that only 60% of Americans have life insurance when everyone should have it? Because it not only supports your family during premature death and acts as a solid financial ally during your life journey.

The number of deaths at a young age has increased dramatically in recent years. Suppose you are the sole breadwinner of your family, and in case you die in an accident. In that case, life insurance will protect the future of your loved ones and help them cover expenses such as loans, paying bills, education, and the standard of living of siblings or children.

If you still need clarification about the importance of life Insurance then scroll down the article till the end. Here, we will discuss five reasons why life insurance is essential.

5 Reasons To Know The Importance of Life Insurance

Help In Pay Off Debt

Millions of Americans take out debt at some point in their lives. Some common forms of debt are mortgages and student loans, which are considered a good part of financial planning.

When a person dies before repaying the outstanding loan, the outstanding amount can put a financial burden on his family estate and heirs.

To pay the balance of every outstanding debt is not the responsibility of the co-signers, heirs, or joint account holders (It’s necessary to remember that each US state has different laws governing how unpaid debts are settled after a person’s death.)

Don’t underestimate the importance of life insurance for a secure future!

To Provide a Secure Future

Another factor that increases the importance of life insurance is a secure future. You can release the financial burden of paying debt by having a perfect life insurance plan as per your needs. If you are the only breadwinner of your family and you have children or dependents, then it becomes more critical for you to prepare for the future.

Life insurance helps in a continuous flow of money in the family, even in the absence of the sole breadwinner of the family. Also, it helps in managing daily expenses like food, utilities, and education.

To Cover Funeral Expenses

Nowadays, funeral expenses have increased to a great extent, so it may increase the financial stress on your family members. If you have life insurance, they may be able to use a portion of the death benefit to pay for funeral expenses. Do consider the importance of Life insurance to cover final expenses.

Helps In Protecting Business

There are several people who do not know that a life insurance company helps in protecting the Business apart from the family. If you work with a professional life insurance company, you may know that some life insurance policies also cover your Business.

If you and your partner are running a business together and something happens to you. Fortunately, life insurance can provide financial security and be a valuable business asset. On the one hand, life insurance benefits can provide a significant amount of money to run a business smoothly, or by having a sell/buy agreement, the surviving partner will have the necessary funds to purchase the successor’s share of the Business. It will offer security to all the involved parties.

Give More Power To Retirement Goals

At some point in life, we all stop working due to the growing age, which we call the retirement age. It also means that the steady flow of your money stops. This situation can put extra stress on you. Therefore, Life insurance is a favorable option to give more power to retirement goals as it is a low-risk investment and can potentially protect you financially during your old age.

How Much Does Life Insurance Cost?

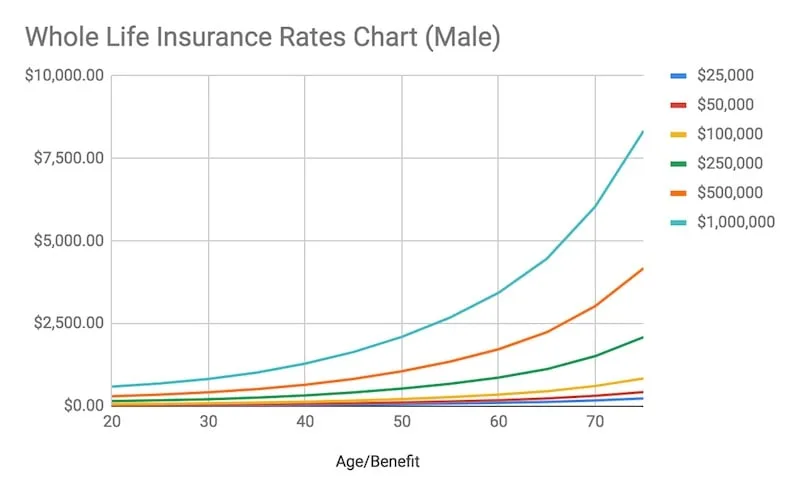

The cost of the best life insurance plan depends on the types of life insurance plans and coverage you choose, as well as your age, gender, health, and lifestyle. There are several healthcare plans available at different prices. For example, A 22-year-old with no pre-existing health conditions may pay less each month than an older person diagnosed with chronic diseases. Therefore, to track the correct life insurance plan cost, first of all you should be clear about your healthcare needs and objectives. It will make your decision more informed.

How Does Life Insurance Work?

When you buy the best life insurance plan, you essentially agree to pay a premium to the life insurance organization in exchange for a death benefit. The death benefit is the money the insurance company pays your beneficiaries when you die. The premium is the amount you pay the company to enforce your policy.

The death benefit is the main motive of life insurance. It is designed to provide financial protection for your loved ones during your death. It can help pay for final expenses, such as funeral costs and outstanding debts. It can also replace your lost income or help your family to fulfill the daily expenses. Hence, you need to consider the importance of life insurance after knowing the above-mentioned crucial reasons.

Save Your Love Ones From Emotional & Financial Burden With a Comprehensive Life Insurance Plan

Death is predestined, and you can’t do anything about it, but you can create a financial support system for your family through Life Insurance. It is an effective medium to protect your family financially during uncertain times. It is vital, not a luxury. Hence, the importance of life insurance is undeniable!

If you’re looking to buy life insurance, the best way to get it is by comparing plans and finding the one that fits your needs best. You can even contact the California Life Insurance Company for professional guidance. We are the best choice for people looking for life insurance coverage on a limited budget. Contact us today!